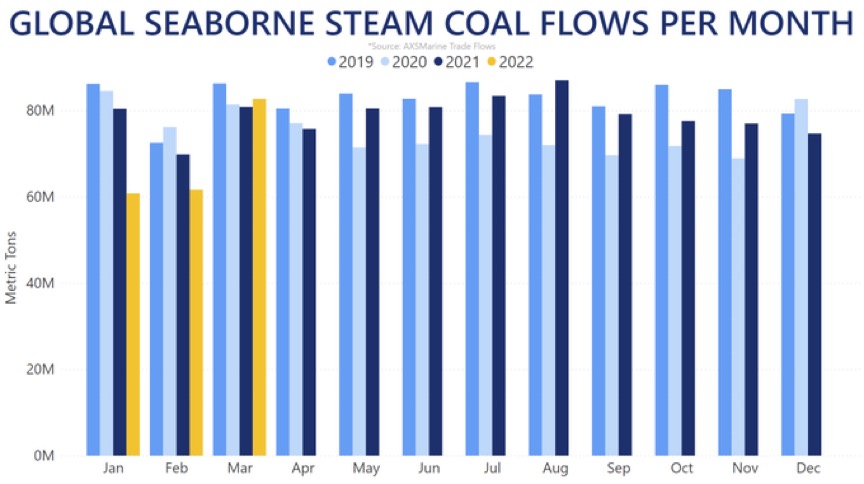

Thermal coal and gas prices have coursed into a bull run, propelled by particularly strong demand across Asia, where electricity consumption is surging thanks to healthy economic growth just as seasonal needs rise with the onset of summer.

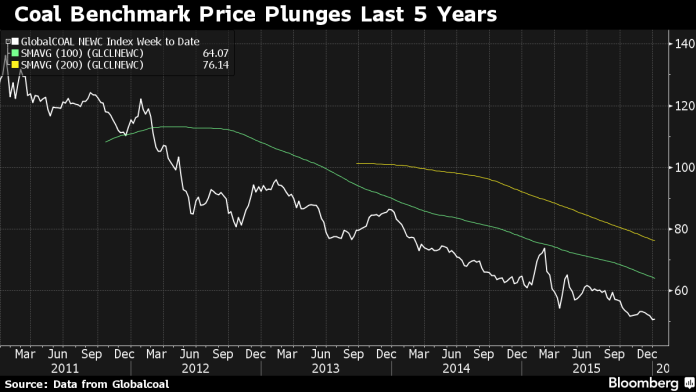

Spot thermal coal cargo prices for export from Australia’s Newcastle terminal last settled at $117/t, the highest level since February 2012. That is up by more than 130% from 2016’s record lows.

Coal prices have not just been pushed up by firm demand, which has recovered from 2015 lows, but also by several mine closures and weak investment into capacity expansion.

In gas markets, spot prices for Asian liquefied natural gas (LNG) are at almost $10 per million British thermal units (mmBtu) – a 2018 high, and up by 145% from 2016 troughs.

“Japanese and South Korean (LNG) storage ended the winter at the lowest levels for at least five years,” said Nicholas Browne, senior gas analyst at energy consultancy Wood Mackenzie.

“Given the strength of Chinese demand last winter, Japanese and Korean buyers utilities want to ensure that storage is full before the winter of 2018/2019 to avoid being caught out,” said Browne.

A procurement official at a Japanese utility said power generators were also stocking up their coal reserves ahead of high electricity demand in summer as the nation switches on air conditioning.

Delays in restarting off-line nuclear power stations in Japan and South Korea also pushed prices higher, Browne said, adding that he saw “spot Asian LNG prices ending the year at close to $12 per mmBtu”.

Thermal coal and gas are the most commonly used fossil fuels for electricity generation.

Fuel oil, used in Asia for power generation as well, has also seen a recent boom.

The surge in prices is costing utilities dearly in North Asia’s economic powerhouses. The world’s second- and third-biggest economies, China and Japan respectively, rely heavily on imports, as does South Korea.

“The current market-based coal price is almost unbearable for us,” said a senior official with China’s second-largest utilities operator China Huaneng Group, declining to be named because he wasn’t authorised to speak to media.

He added, however, that strong industrial demand for electricity was in turn generating healthy revenue, and that cheaper long-term coal supply contracts under government price controls were shielding the company from some of the high import costs.

The bull run in fuel demand and prices is a boon for producers.

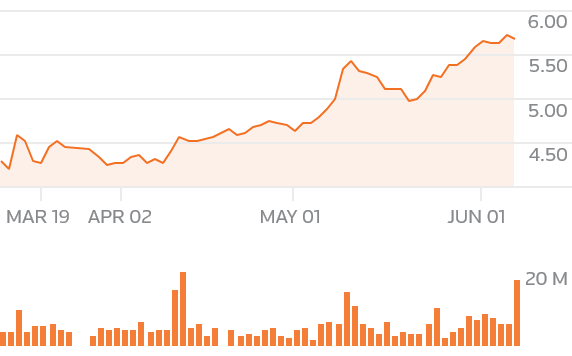

Australia’s Whitehaven Coal has seen its share price chasing records for much of this year. Meanwhile, LNG specialist Santos in May fended off a $10.8 billion takeover bid by an investor group that was keen to get a share in the booming market.

Coal and gas usually take their lead from oil markets, yet that’s not been the case recently.

Although oil prices have also risen this year, in part due to healthy demand but mostly because of voluntary production cuts led by producer cartel OPEC. But crude markets have more recently come under pressure following rising output from all three of the world’s top producers, Russia, the United States and Saudi Arabia.