This week, the European Union summit unveiled a draft statement noting that member states would agree to gradually reduce dependence on Russian energy sources, including coal. However, no specific date was given and, according to an EU spokesman, the member states are planning to phase out Russian resources between 2027 and 2030.

Josep Borrell, EU representative for international affairs and security policy, confirmed that fuel imports from Russia could not be banned, while the German Foreign Minister noted that otherwise Europe would have faced a transport system collapse.

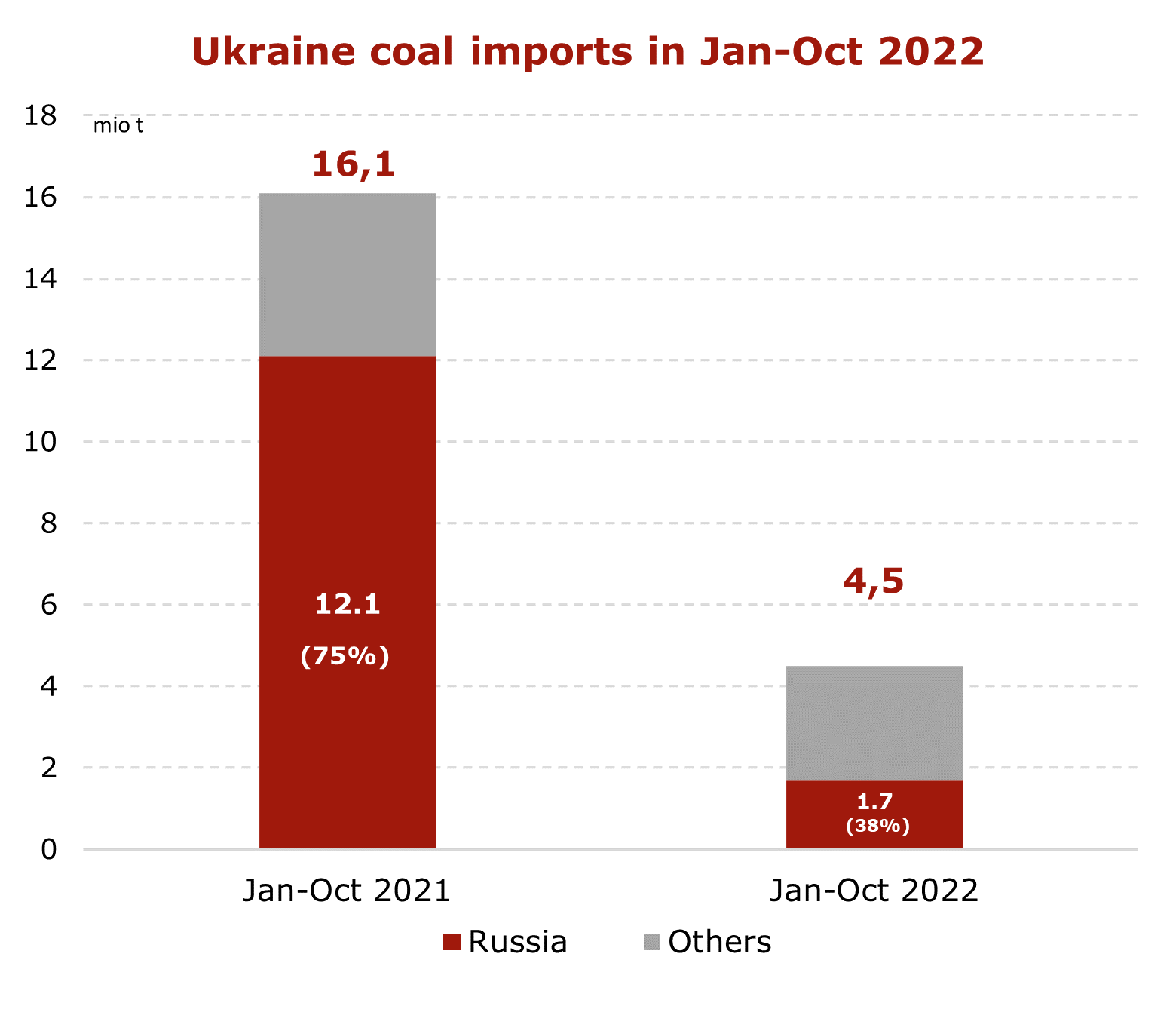

The plan for the EU to completely turn away from Russian coal, oil and gas looks unrealistic, according to some experts, and despite the pressure of the government in connection with the conflict in Ukraine to reduce imports and impose appropriate sanctions, the block can’t help but relies on Russia, as the country remains the largest supplier of energy resources. Russia accounts for 46% of coal imports, 27% of crude oil imports and about 40% of all gas consumption by the EU.

Due to the inability to ban imports, the European Commission has proposed an accelerated phase-out plan for Russian energy by 2030, which will oblige all member countries to fill their gas storage facilities to at least 90% of capacity by October 1 of each year. The document is aimed primarily at a significant reduction in dependence on Russian gas supplies by the end of 2022. The relevant legislative proposal will be presented next month.

However, as experts note, only Russian coal can become an alternative to Russian gas for Europe. The European Commission’s draft plan, called REPowerEU, includes measures such as diversifying imports with LNG from other countries, processing biomass, increasing renewable energy capacity, increasing hydrogen production and improving energy efficiency. Consumers are even encouraged to lower the air temperature in their homes.

Nevertheless, cutting the supplies of Russian fuel will lead to higher costs of electricity and production in Europe in all sectors, stagflation, higher prices of gasoline and heating, leading to a full-fledged energy and economic crisis. Amid governments discussions of the possibility of imposing sanctions on fuel imports from Russia in Europe, coal and gas prices reached all-time highs of 417.16 USD/t and almost 4,000 USD/1,000 m3, respectively, while crude oil returned to 130 USD/barrel, a record high since 2008.

Some EU countries strongly oppose turning away from Russian fuel imports. So, due to a sharp 5-10-fold increase in electricity prices, some production facilities are already being suspended in Italy, with Hungary and Bulgaria making it clear that they see no alternatives to supplies from Russia. The Prime Minister of Bulgaria even brought up the possibility of leaving the EU in case of Russian energy imports being banned.

Source: CAA