August data points to a split picture, with thermal coal clawing back momentum while metallurgical flows continue to slide under weak steel output and lingering port bottlenecks.

August demand was mixed as some Asian buyers eased post-peak summer demand while others remained strong on account of restocking. South Korean demand rose a significant 79% y-o-y reflecting strong restocking following high summer baseload demand. Demand from China continued its soft trend falling 8% y-o-y, though recording the highest monthly imported volume of the year at 26.9Mt.

On the supply side, Russian exports surged largely driven by increased demand in South Korea and parts of southeast Asia, jumping 21% y-o-y. Australia supply slipped 9% y-o-y to 19.7Mt on account of limited spot trade with ongoing vessel queues at the ports in Newcastle following inclement weather in May.

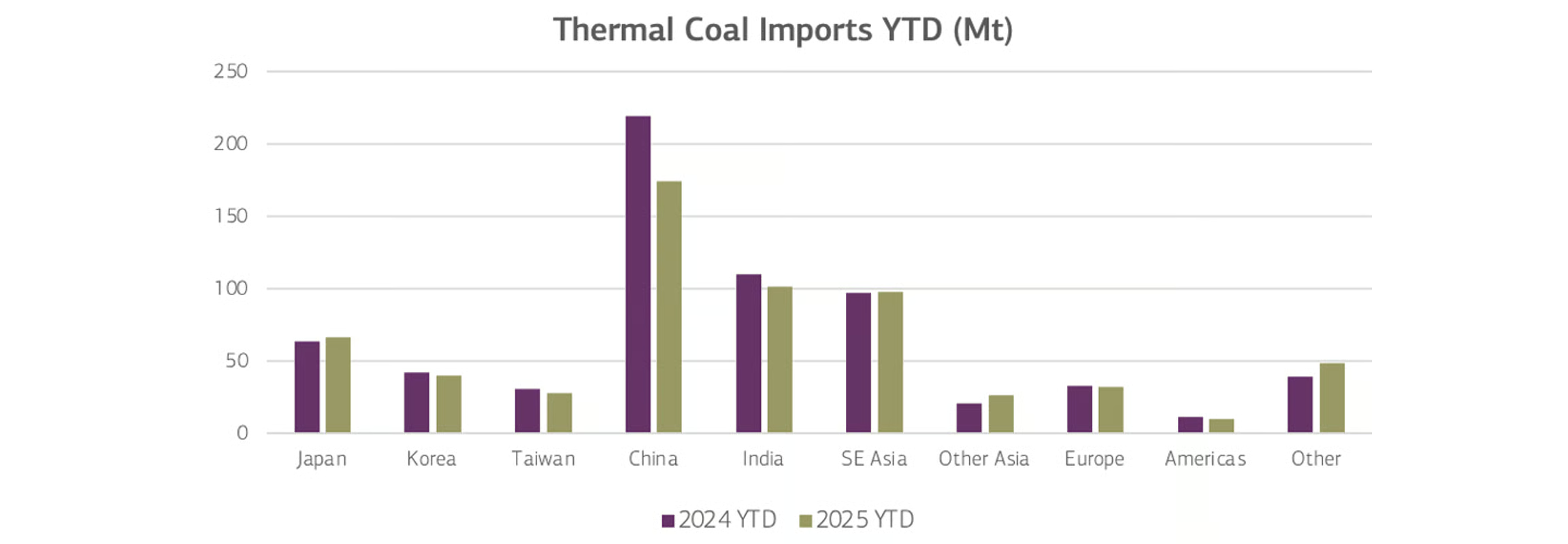

Despite ongoing price competitiveness to gas and other fuels, year-to-date (YTD) volumes for globally traded seaborne thermal coal are down 6% y-o-y (see chart below), reflecting the impact of rising domestic supply in key markets alongside expanding renewable and nuclear generation that continue to displace imports.

August’s demand saw China’s imports fall 14% y-o-y to 5.4Mt as mills were suspended ahead of national parades, while South Korea dropped 24% y-o-y to 2.1Mt as steel production continues to slow.

On the supply side, United States exports fell for a fifth straight month since March, plunging 48% y-o-y to 2Mt, an eight-year low amid persistent trade tensions that depressed shipments to India (down 8% to 0.6Mt), Europe (down 39% to 0.6Mt) and Brazil (down 24% to 0.4Mt). Australia’s August exports also declined 11% y-o-y to 11.1Mt as closures at Moranbah North and Grosvenor and reduced output at the Burton mine complex curtailed seaborne sales.

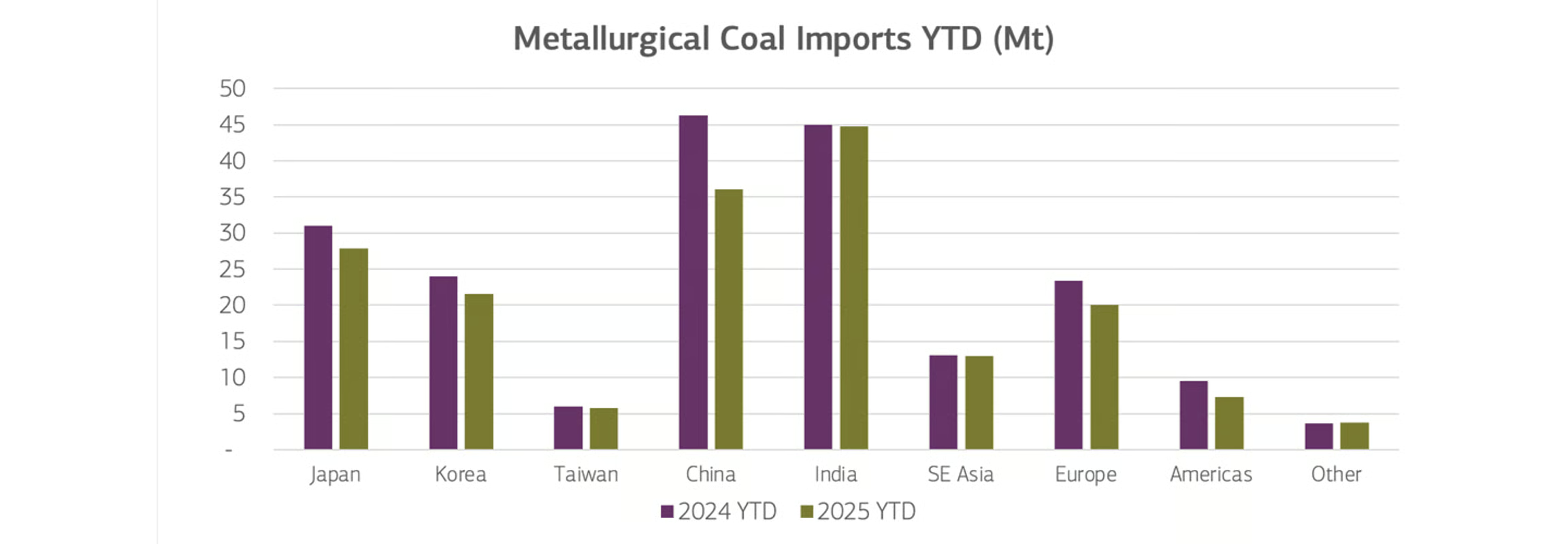

Year-to-date seaborne metallurgical coal shipments stand at 180Mt, down 13% y-o-y, underscoring the sustained impact of logistical disruptions, mine closures and weak pricing on global trade flows.

Source: Commodity Insights