After enduring a tumble of Yuan 800/tonne ($122.1/t) in their domestic coke prices over the past five weeks, Chinese coke makers are now pushing back against the steel mills. The independent merchant coke producers are started to press for a raise of at least Yuan 100/t, citing the high margins the steelmakers are enjoying, against the heavy cost pressure they’re facing in their coking operations.

Leading coking plants in North and East China including many in Shanxi, Hebei and Shandong provinces have notified their clients they are adding Yuan 110/t to their prices of dry-quenching coke and Yuan 100/t to wet quenching coke prices from April 6, according to sources.

These makers justified their decisions on the notable improvement in coke sales, arguing that in contrast to the climb in steel margins, the coking margin has narrowed significantly. However, as of the afternoon April 6, Mysteel Global had not heard of any steel mill conceding to the adjustment.

As of April 6, Mysteel’s composite coke price had declined Yuan 48.1/t on week to Yuan 2,047/t including the 13% VAT, a six-month low. As recently as February 18, the price had reached an over 12-year high after the domestic coke makers had succeeded in raising prices steadily upwards by a total of Yuan 1,000/t since mid-August last year, as reported.

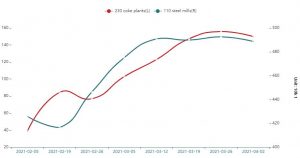

According to Mysteel’s latest surveys conducted on April 1, the steady climb in total coke stocks since early February at the 230 Chinese independent coking plants tracked nationwide in the sample had ceased. As of last Thursday, the inventories had dropped 4% on week to 1.5 million tonnes, while those at the 110 surveyed steel mills edged down 1% on week to 4.9 million tonnes, as reported.

Chart: Mysteel’s survey on coke stocks at coking plants and steel mills

Source: Mysteel

As of April 1, the average coking margin of the 30 independent coke makers Mysteel checks weekly had fallen by another Yuan 135/t on week to Yuan 330/t, a low since September 18 2020. The same day, Mysteel’s assessed margin for rebar (blast furnace- produced) had increased by Yuan 122/t on week to Yuan 977.3/t.

Nevertheless, some analysts have little confidence that the higher coke price will materialise.

“I think the strategy of the (domestic) coking plants is just to stop coke prices from declining further, rather than attempting to force the steelmakers to concede to pay higher prices,” a Shanghai-based analyst said, adding that China’s coke supply remains sufficient for current demand.

A source in Shanxi agreed. “There is no sign of rising procurement from domestic steel mills yet, particularly from those in Tangshan since the city started production cuts for air pollution reduction in late March,” he observed.

Source: Sean Xie & Russ McCulloch

Follow on Twitter:

[tfws username=”MysteelGlobal” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]