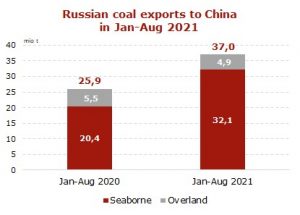

In January-August 2021, the total Russian coal exports to China, according to preliminary data, increased to 37.0 mio t (+11.1 mio t or +43% y-o-y), including seaborne and overland supplies.

Nevertheless, coal exports through border crossings with China in January-August 2021 decreased to 4.94 mio t (-0.54 mio t or -10% y-o-y). Coal deliveries via Kamyshovaya-Hunchun checkpoint increased to 1.97 mio t (+0.38 mio t or +24% y-o-y), through Zabaikalsk-Manchuria slashed to 1.87 mio t (-0.69 mio t or -27%) and via Grodekovo-Suifenhe totaled 1.1 mio t (-0.23 mio t or -17%).

Russian suppliers periodically filed complaints on issues with delays in cargo transportation through border crossings with China. Russian Railways (RZD) were forced to periodically impose bans on rail shipments of coal due to congestion on routes to Russian-Chinese border crossings amid Covid-19 quarantine measures by the Chinese customs, leading to a slowdown in cargo handling and a reduction in the supply of Russian material.

China’s total coal imports in January-August 2021 plummeted to 198 mio t (-22.4 mio t, or -10% y-o-y). Despite the decline in Chinese imports, Russian suppliers managed to increase their share in the overall volume of coal shipments to China up to 19% in January-August 2021 from 12% over the same period of 2020.

The main reason for the downturn in China’s imported volumes is the ban on imports from Australia owing to political tensions between the countries. In 2021, China faced a shortage of material, including a decrease in production by Chinese coal companies caused by restrictive quarantine measures and safety checks at mines amid increased demand, that, starting from September 2021, led to an energy crisis in the country. The north-eastern provinces of China experience a coal shortage and are forced to turn off traffic lights, escalators and 3G towers to save energy. In many provinces, the authorities offer businesses to reduce their electricity consumption, causing significant damage to the industry, the restrictions are also applied to local communities. Goldman Sachs estimates that 44% of Chinese businesses have been affected by electricity shortfall. Thermal coal prices on the China’s domestic market more than doubled, exceeding 200 USD/t, compared to the price level of 90 USD/t in September 2020.

In Q4 2021, China will have to increase coal imports, including shipments from Russia. However, despite the steady growth in the exports of Russian material and the surge in coal demand by China and other countries of the Asia-Pacific, the export potential of Russian suppliers remains limited due to the restricted railway capacities of the Eastern range.

Source: CAA Analytics