Global coal trade has really picked up pace over the past year, and is now fully back to pre-Covid levels.

In Jan-Oct 2024 the positive trend continued, with global coal loadings increasing by +2.3% y-o-y to 1132.4 mln t, from 1107.4 mln t in the same period last year, based on vessel tracking data from AXS Marine.

In Jan-Oct 2024, exports from Indonesia increased by +7.9% y-o-y to 438.5 mln t, whilst from Australia were up +3.4% y-o-y to 291.6 mln t.

From Russia exports declined by -13.4% y-o-y to 137.2 mln t in JanOct 2024, from the USA increased by +5.0% y-o-y to 75.0 mln t, from South Africa were flat -0.0% y-o-y at 49.9 mln t.

Shipments from Colombia increased by +2.7% y-o-y to 47.6 mln t in JanOct 2024, from Canada increased by +0.2% y-o-y to 41.1 mln t, and from Mozambique were down by -11.1% y-o-y to 17.7 mln t.

Seaborne coal imports into Mainland China increased by +14.4% y-o-y to 342.5 mln t in Jan-Oct 2024, to India increased by +3.8% y-o-y to 202.9 mln t, to Japan declined by -3.1% yo-y to 129.7 mln t in Jan-Oct 2024.

Shipments to South Korea declined by -5.6% y-o-y to 92.4 mln t, to the EU down -32.7% y-o-y to 51.3 mln tonnes, to Vietnam surged by +22.7% y-o-y to 48.1 mln t, to Taiwan declined by -6.2% y-o-y to 47.4 mln tonnes in Jan-Oct 2024.

Mainland China is currently the world’s largest seaborne importer of coal (including both thermal and coking), accounting for 27.5% of the global seaborne coal market in 2023.

It is ahead of India, which accounts for 18.0% of coal trade and Japan with a 12.0% market share.

Total seaborne coal imports into China in the 12 months of 2023 reached 368.4 mln tonnes, according to Refinitiv vessel tracking data.

This was up +48.6% y-o-y from the 248.0 mln tonnes of 2022, and +23.5% from the 298.2 mln t in 2021, and also +50.7% above the 244.5 mln tonnes imported in 2020.

In Jan-Oct 2024, imports into China increased by +14.4% y-o-y to an all time record high of 342.5 mln t. In Jan-Oct 2024, most coal volumes into China were loaded on Panamax vessels (50.9%), with 24.2% on Supramax and Ultramax vessels, 6.8% on Post-Panamaxes and 15.0% on Capesize tonnage.

Top discharge ports for coal imports into China in Jan-Oct 2024 were Machong (20.3 mln tonnes of coal in Jan-Oct 2024), Fangcheng (19.3 mln t), Qinzhou (16.3 mln t), Gaolan (14.9 mln t), Caofeidian (14.0 mln t), Meizhou (14.0 mln t), Shanghai (11.6 mln t), Nanjing (9.3 mln t), Ningbo (8.6 mln t), Haimen (8.3 mln t), Guangzhou (8.3 mln t), Dongwu (7.6 mln t), Xiamen (7.6 mln t).

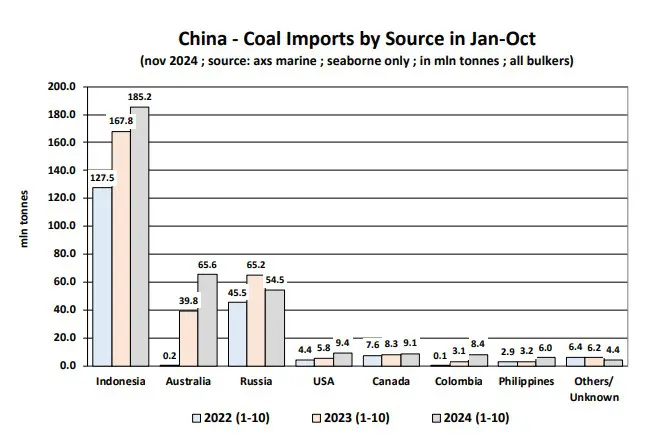

Indonesia is still by far the top supplier of coal to China accounting for 54.1% of China’s imports in the first 10 months of 2024.

Arrivals from Indonesia increased by +10.4% y-o-y to 185.2 mln tonnes in Jan-Oct 2024 compared to 167.8 mln t in Jan-Oct 2023.

Australia is now back (!) and the second largest supplier of coal into China with a share of 19.1%. In Jan-Oct 2024, China imported 65.6 mln tonnes of coal from Australia, up +65.0% y-o-y from 39.8 mln tonnes in Jan-Oct 2023.

It should be noted that volumes were just 0.2 mln t in Jan-Oct 2022, when the boycott against Australian coal was still being enforced. The third largest supplier of coal to China is Russia, accounting for a 15.9% share of Chinese imports.

Coal shipments from Russia to China declined by -16.5% y-o-y to 54.5 mln t in Jan-Oct 2024, from 65.2 mln t in Jan-Oct 2023, but are still above the 45.5 mln t in Jan-Oct 2022.

Most Russian shipments are sourced from the Far East region of the country, with 13.2 mln t imported in Jan-Oct 2024 from the port of Vanino, 9.3 mln t from Vostochny, 9.3 mln t from Shakhtersk, 6.8 mln t from Nakhodka.

Coal volumes from Colombia to China have also skyrocketed to 8.4 mln t in Jan-Oct 2024, from just 3.1 mln t in the same period of 2023.

Source: Bancosta