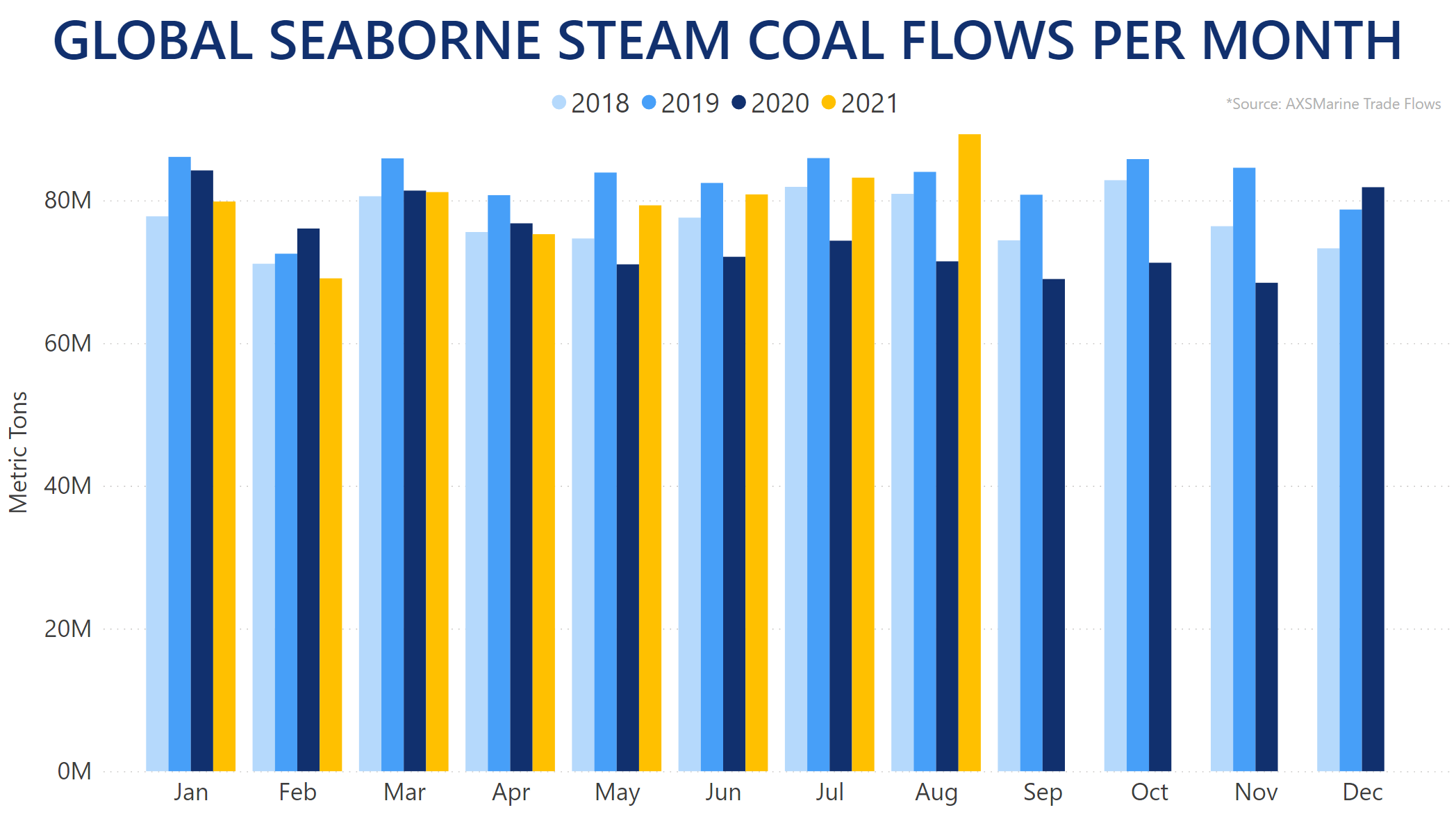

Global coal trade has really picked up pace in recent months, and is now fully back to pre-Covid levels.

In Jan-Dec 2023, global seaborne coal loadings increased by +6.0% yo-y to 1,341.2 mln t (excluding cabotage), based on vessel tracking data from AXS Marine.

This was well above the 1,265.5 mln t loaded in Jan-Dec 2022, the 1,254.2 mln t in Jan-Dec 2021, and the 1,196.5 mln t in Jan-Dec 2020.

It was also a little above the 1,309.8 mln t loaded in Jan-Dec 2019.

In Jan-Dec 2023, exports from Indonesia increased by +10.5% y-o-y to 496.0 mln t, whilst from Australia were up +4.8% y-o-y to 344.9 mln t.

From Russia exports declined by -2.4% y-o-y to 184.0 mln t in 2023, from the USA increased by +16.7% yo-y to 86.6 mln t, from South Africa declined -0.3% y-o-y to 60.4 mln t.

Shipments from Colombia increased by +2.0% y-o-y to 56.4 mln t in JanDec 2023, from Canada by +10.2% yo-y to 50.2 mln t, and from Mozambique surged by +14.6% t-o-y to a record 23.7 mln t.

Seaborne coal imports into Mainland China jumped by +48.6% y-o-y to 368.4 mln t in Jan-Dec 2023.

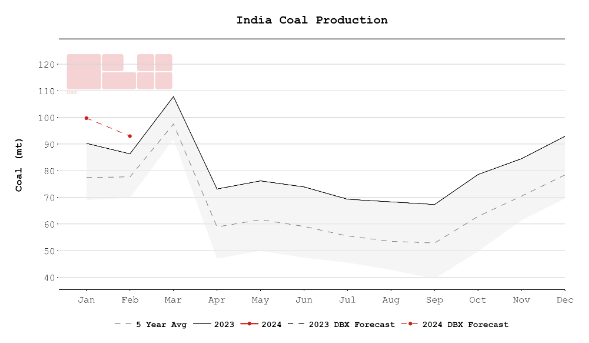

Imports to Japan declined by -10.3% y-o-y to 160.5 mln t in Jan-Dec 2023, to South Korea by -4.4% y-o-y to 117.4 mln t, to Taiwan -4.3% y-o-y to 58.3 mln t, whilst to India increased by +6.9% y-o-y to 240.8 mln t and to Vietnam +54.2% y-o-y to 47.4 mln t.

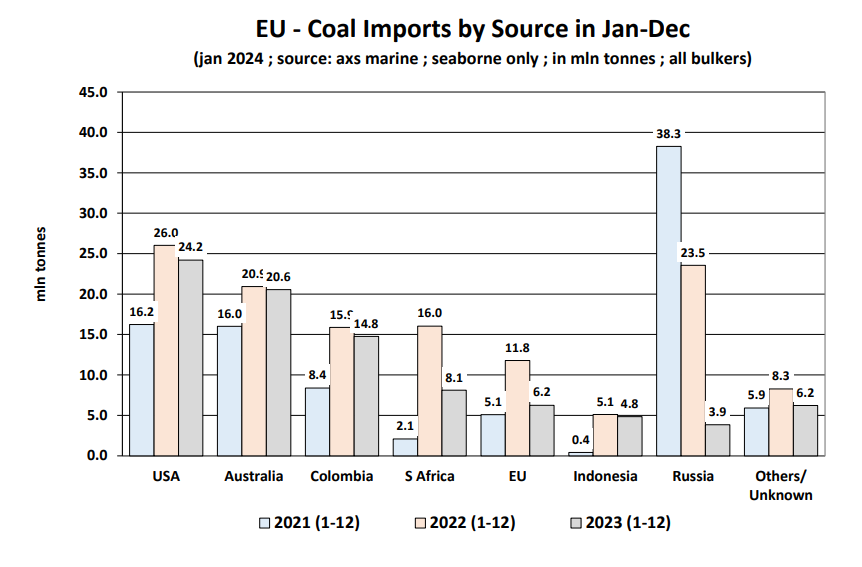

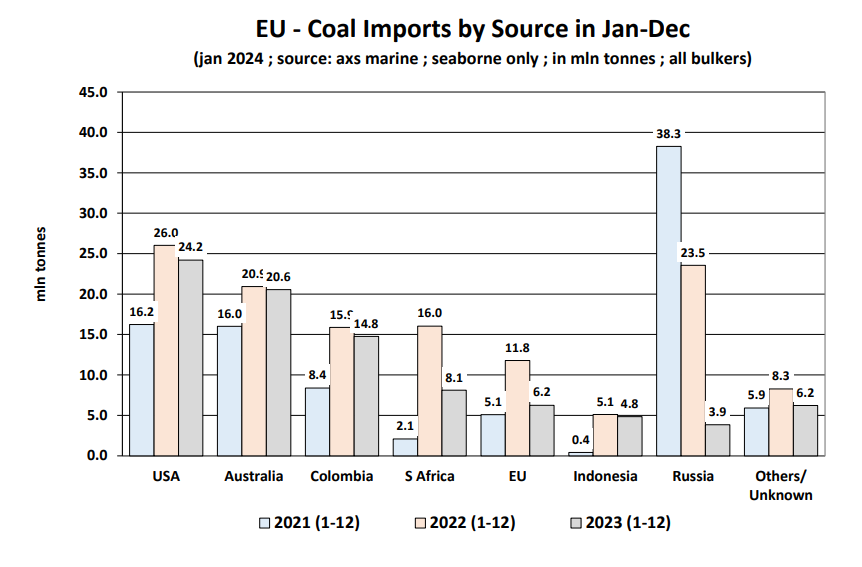

The European Union is now the fifth largest seaborne importer of coal in the world, after China, India, Japan and South Korea.

In 2023, the EU accounted for 6.6% of global seaborne coal shipments.

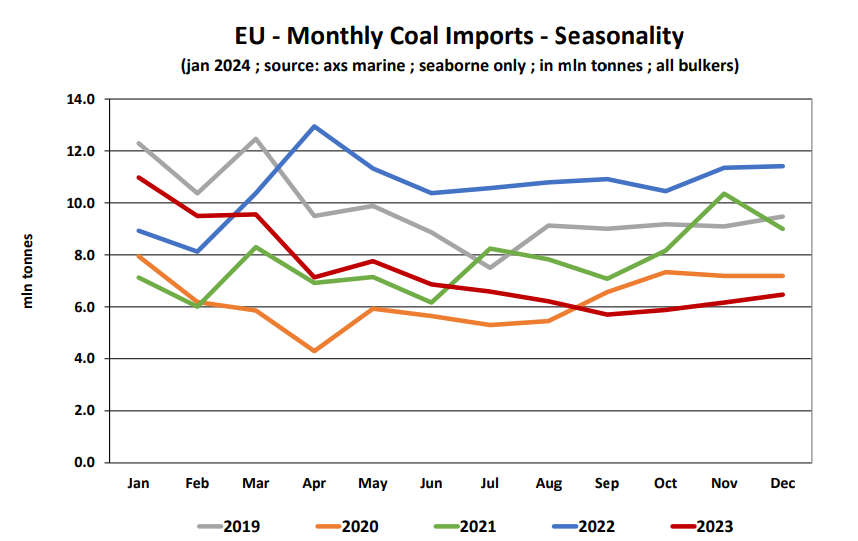

The EU’s seaborne coal imports surged in 2022 by +38.2% y-o-y to 127.6 mln tonnes as a consequence of lower gas imports from Russia, but have now again softened back.

In 2023, in fact, European seaborne imports declined sharply by -30.4% y-o-y to just 88.8 mln tonnes, the lowest level in recent years after (Covid-affected) 2020.

This essentially returns Europe to a previous trend where it progressively abandoned coal as a source of energy and embraced natural gas and renewables.

We already saw European coal imports declining by -32.9% y-o-y in 2020, by -18.3% y-o-y in 2019, by -7.6% y-o-y in 2018.

In terms of sources of the shipments, Europe was heavily dependant on Russia, but this has now drastically changed.

In 2021, as much as 44% of the EU’s seaborne coal imports were sourced from Russian ports.

In 2021, as much as 44% of the EU’s seaborne coal imports were sourced from Russian ports.

In 2023, as a result of the war in Ukraine, this proportion declined to 4.3%, which also includes Kazakh

coal shipped through Russian ports.

In Jan-Dec 2023, coal imports to the EU from Russian ports declined by-83.6% y-o-y to just 3.9 mln tonnes

(again including Kazakh coal).

The most important supplier to Europe in 2023 was the USA, accounting for 27.3% of Europe’s imports.

In 2022, volumes from the USA surged by +60.5% y-o-y to 26.0 mln t, but in 2023 they corrected down by -7.0% y-o-y to 24.2 mln t.

The second largest supplier to Europe is Australia, accounting for 23.2% of the EU’s imports in 2023.

In 2022, imports from Australia increased +30.8% y-o-y to 20.9 mln t, but in 2023 declined -1.8% y-o-y to 20.6 mln t. In third place was Colombia, with a 16.6% share. In 2022, volumes surged by +89.2% y-o-y to 15.9 mlnt, but in 2023 declined by -7.0% y-oy to 14.8 mln t.

In fourth place was South Africa, with a 9.1% share of Europe’s coal imports in 2023.

In 2022, EU imports surged by +676.4% y-o-y to 16.0 mln t, but in 2023 declined by -49.5% y-o-y to 8.1 mln t.

Indonesia accounted for 5.4% of coal imports into Europe in 2023.

Volumes from Indonesia to the EU surged by +1148% y-o-y in 2022 to 5.1 mln t, but declined by -5.2% y-o y in 2023 to 4.8 mln t.