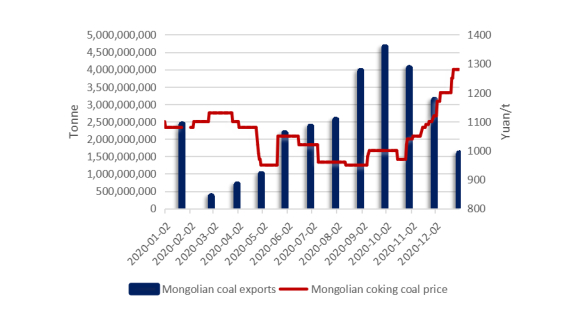

Mongolia’s total coal exports during 2020 plunged by 22% to 28.6 million tonnes, well below the target set by Ulan Bator at the start of the year to lift exports to beyond 40 million tonnes last year. The outbreak of the COVID-19 pandemic was the chief reason for the plunge in Mongolian coal deliveries, Mysteel Global noted.

Last December alone, Mongolia exported 1.6 million tonnes of coal, lower by 49.3% on month or 5.6% on year to an eight-month low, according to the country’s Customs data. Traders and end-users in China, bordering southern Mongolia, bought over 95% of the coal Mongolia shipped last year, the data showed.

The pandemic caused a marked slowdown in Mongolian coal exports over February-April last year, during which the Ulan Bator government announced it was suspending coal deliveries from mid-February to late March to contain the spread of the virus. Although trucks laden with Mongolian coal were permitted to cross some checkpoints on the Mongolia-China border from last March 23, the number was strictly controlled to only several hundred trucks/day in some key coal trading border ports. This was in sharp contrast to the over 1,000 trucks/day in normal times, as reported.

To boost economic recovery as the pandemic eased, Mongolian and Chinese authorities reached agreements to accelerate coal trading from August by extending Customs clearance hours and implementing fast-track systems for goods delivery. Although Mongolia’s coal exports hit a high last September, the result could not cushion the sharp decline in last year’s H1.

The smooth coal trading between Mongolia and China was disrupted again from late November when a new wave of the pandemic hit both countries. As Chinese and Mongolian government authorities adopted immediate COVID-19 tests on truck drivers, coal transportation was disrupted again.

Chart: Mongolia’s coal exports by month and Mongolian coking coal prices

Source: Mongolia’s Customs, Mysteel

Last year, the price trend of Mongolian coking coal price in China moved in almost the opposite direction to coal exports, according to Mysteel’s data. Through 2020, Mysteel’s price assessment for Mongolian processed coking coal with 10% ash, 27% volatile matter and 0.65% sulphur increased Yuan 180/tonne ($27.9/t) on year to Yuan 1,280/t at the border checkpoint and including the 13% VAT.

As China has unofficially restricted Australian coking coal imports, traders and end-users in North and Northwest China – the main markets for Mongolian coking coal – have been in a hurry to procure Mongolian coal to replace Australian coal, Mysteel Global noted.

But even if Mongolian coal deliveries are smooth and impacted little by the pandemic situation, for Mongolian exports to fully offset the decline in Australian coking coal shipments to China remains hard to imagine, said a Shanghai-based analyst.

“The quality of Australia’s premium low volatile products is better than Mongolian coal, and by shipping in large quantity to China, the transportation charges are highly competitive too,” he explained.

Written by Sean Xie

Edited by Russ McCulloch