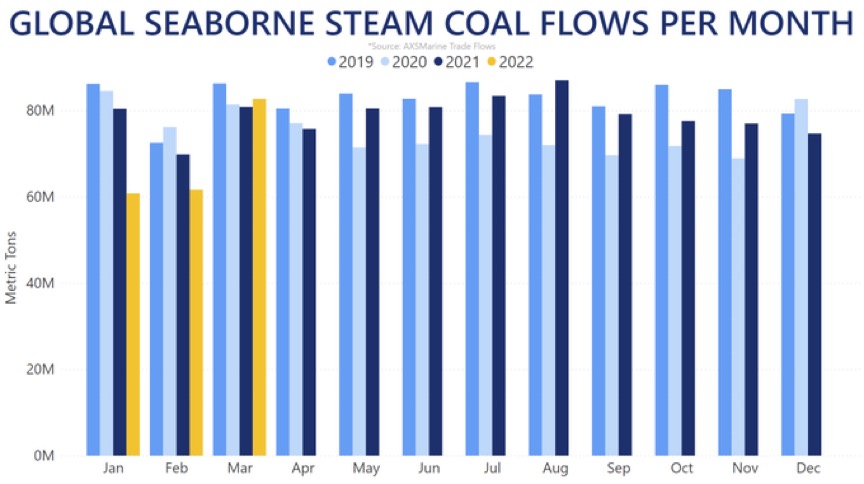

In 2009 the global coal market witnessed one of the most dramatic realignments it has ever seen – China, long a net exporter of coal, suddenly imported a record-smashing 126 Mt tons (see Figure 1)

This inversion of China’s role in global coal markets meant that Chinese imports accounted for nearly 15% of all globally traded coal, and China became the focal point of global demand as traditional import markets like Europe and Japan stagnated in the wake of the financial crisis.

By the first quarter of 2010, even Colombia was defying established trade patterns by sending cargoes to China despite its massive geographic disadvantage to export coal into Asian markets. The middle kingdom’s appetite for imported coal seems insatiable, and the “China Factor” appears to have ushered in a new paradigm for the global coal market.

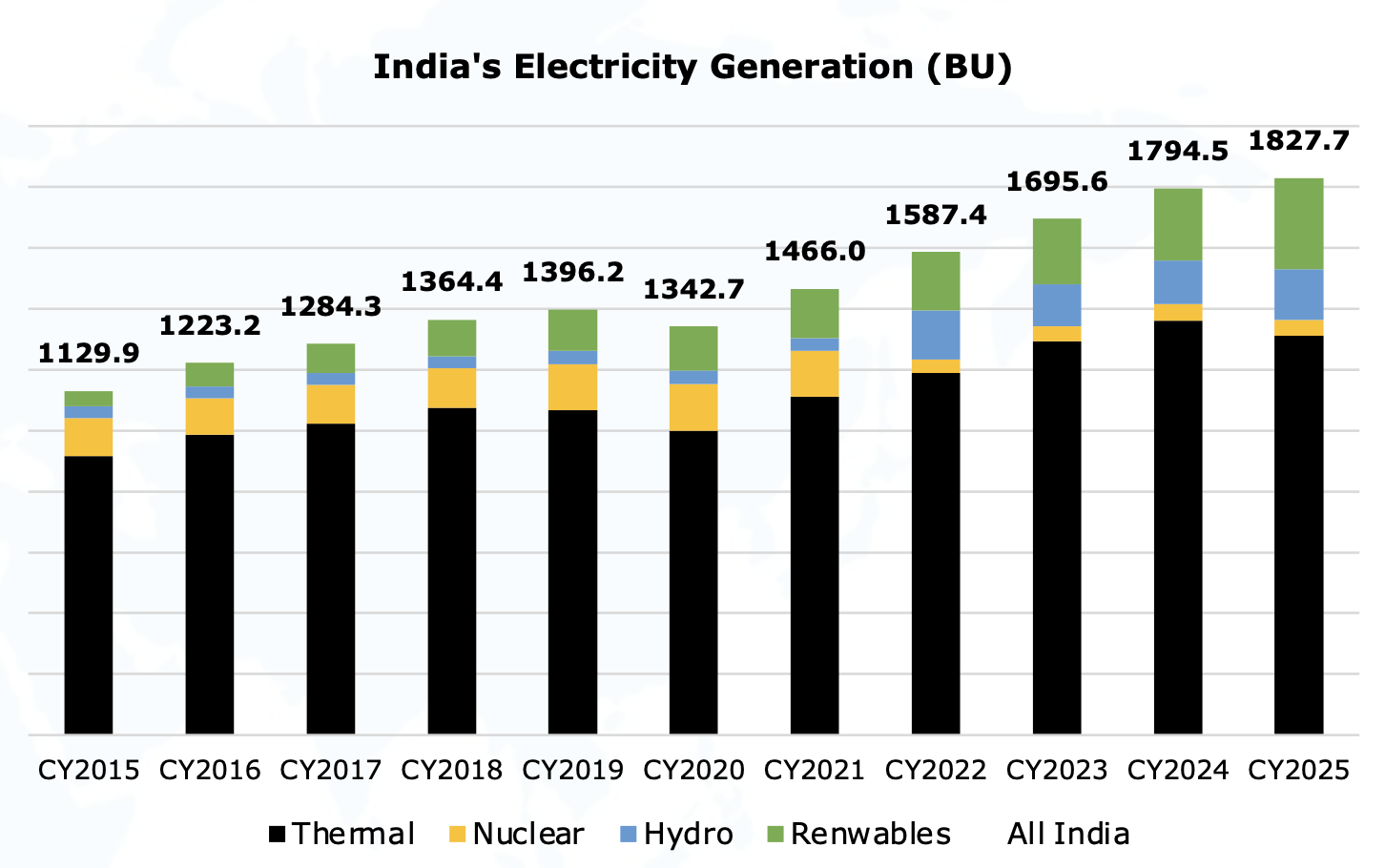

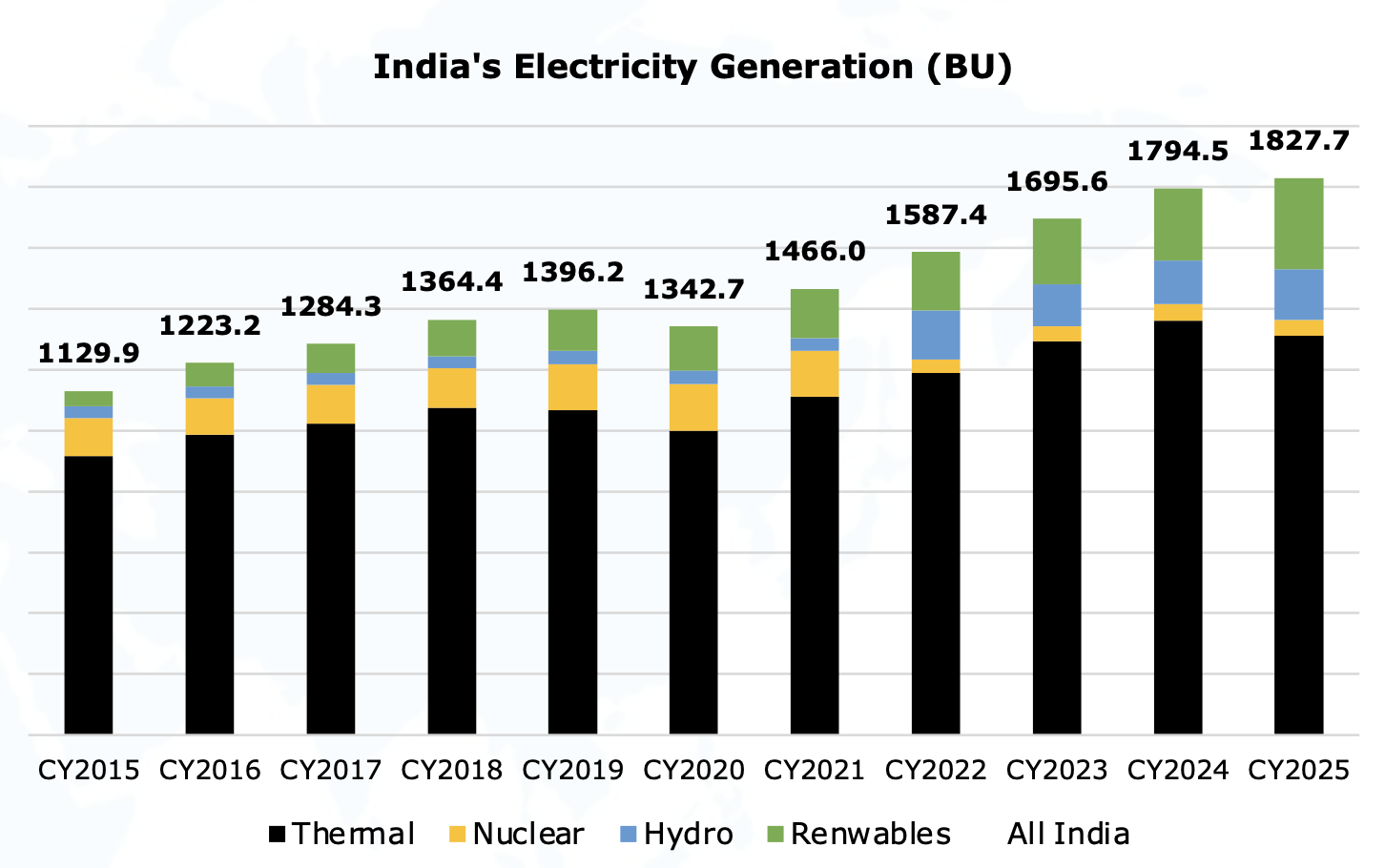

But China doesn’t “need” the coal. The world’s largest coal producer cranked out 2.96 Bt of production in 2009, backed up by 114.5 Bt of reserves.2 While the world’s other fastest growing importer, India, is plagued by a growing gap between coal supply and power demand that it is unable to fill domestically, this is not the case in China.

The spike in Chinese demand for imported coal is therefore a more complex (and less easily predictable) phenomenon that requires careful examination if the world is to understand what impact China might have on global energy markets in the coming decade.