Russian exporters redirect coal supplies from European to Asian markets, leaving Latvian ports with a little coal-handling volumes amid lowering demand for thermal coal in Europe as a result of the growing share of renewables in the EU power mix, second wave of Covid-19 and tough competition of coal with natural gas.

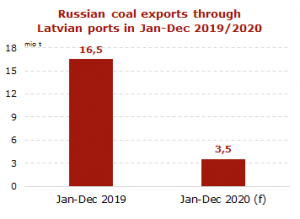

In January-December 2020 Russian coal exports through Latvian ports is forecasted to decrease to 3.5. mio t (-13.0 mio t or -79% y-o-y). Russian coal suppliers increase exports through domestic Baltic ports (mainly in Ust-Luga) instead of transshipment via Latvian port capacities.

In January-November 2020 coal handling through the port of Ust-Luga surged to 33.58 mio t (+3.19 mio t or +10.5% y-o-y). In November, the Deputy Minister of transport of Latvia Uldis Reimanis sent a letter to the assistant of the Russian Minister of transport Yuri Petrov with a complain that Latvian ports of Riga, Ventspils and Liepaja did not receive sufficient volumes of cargo.

Ust-Luga Coal Terminal (Rosterminalugol) is the largest Russian coal terminal in the Baltic. In addition to Ust-Luga Coal Terminal, there are three more coal handling terminals in Ust-Luga port: Multipurpose Reloading Complex (MRC), Yug-2, Ust-Luga Container Terminal (ULCT). The overall coal throughput of all Ust-Luga terminals in 2019 reached roughly 34 mio t.

Source: CAA Analytics

[tfws username=”CAA_Analytics” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]