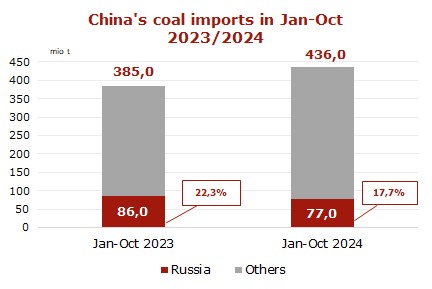

Russian coal exports to China in January-October 2024 dropped to 77.0 mio t (-9.0 mio t or -10.5% vs. Jan-Oct 2023).

Meanwhile, in the first 10 months of 2024, Chinese total coal imports climbed to 436.0 mio t (+51.0 mio t or +13.2% y-o-y).

Russia’s share in Chinese coal imports in January-October 2024 declined by 4.6% to 17.7% from 22.3% over the same period in 2023.

The drop in Russian coal export supplies is linked to critical logistical issues, as well as international sanctions, depressed world prices and high production costs, forcing most producers to export coal at zero or negative margins.

Russian suppliers have to reduce exports on all routes. Coal shipments via terminals in the South and North-West remain unprofitable, while access to rail capacity is restricted on the back of rising transportation costs.

Russia is the second largest coal exporter to China after Indonesia. It is followed by Mongolia and Australia. Over 10 months of 2024, all of these countries managed to ramp up their supplies to China, especially Australia, with its exports jumping by 25 mio t, or almost 63%. Thus, given the logistical challenges and high transportation costs, the lost tonnages of Russian coal on the Chinese market are being replaced by shipments from competing countries.

Source: CCA Analysis