Last week, European thermal coal indices fell below 275 USD/t, following a drop in gas prices and positive shifts in the negotiations between Russia and Ukraine. Germany refused to support the EU initiative to impose an immediate ban on Russian coal imports, however, plans to stop buying coal from Russia by this September, while Poland intends to cut off Russian coal supplies by May 2022. Moreover, Poland decided not to wait for the approval from the European Commission and stop to import Russian coal at the state level, despite it would contradict the EU trade law. Coal stocks at ARA terminals amounted to 3.2 mio t (+0.3 mio t by March 23, 2022).

South African coal index also adjusted below 265 USD/t. South African rail operator Transnet will not manage to transport the planned 70 mio t of coal this year, driven by weak Q1 2022 results. (14 mio t versus 15.6 mio t in Q1 2021). This year’s loading is expected to be 60-65 mio t, i.e. increase by about 20% from 58 mio t in 2021, but will not exceed the 2020 level of 70 mio t.

In China, spot prices for 5500 NAR fell by almost 26 USD/t to 227 USD/t FOB Qinhuangdao. Coal indices in China’s domestic market continued to correct amid recently imposed restrictions, resulting from COVID-19 outbreak and fears of tighter monitoring and control by local regulators. Next month China’s National Development and Reform Commission (NDRC) is launching an online platform to monitor prices and transactions to stabilize the market. According to NDRC order, from April 01, 2022 all mining companies will be required to provide information on prices and production costs, while data on spot market transactions will have to be reported on a daily and weekly basis.

Australian coal prices rose to 270 USD/t, being supported by the increased demand from Asian and European consumers. Japanese company Idemitsu Kosan rejected new supplies of Russian coal in favor of Australia due to the uncertainty with payment and possible logistical constraints.

Indonesian 5900 GAR decreased to 209 USD/t FOB Kalimantan on the back of lower activity of Chinese buyers. At the same time, Indonesian mining companies point out that they will not be able to meet March production and export plans because of heavy rains and insufficient number of barges, the availability of which is limited by redirecting most of them to operate in the domestic market.

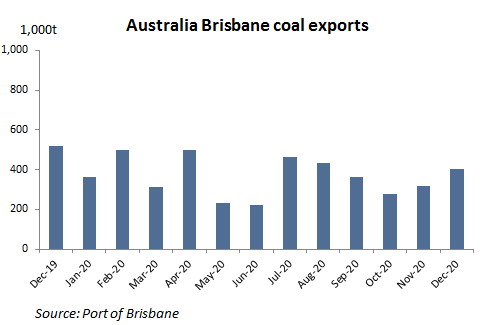

Australian metallurgical coal indices fell below 520 USD/t as export shipments increased by 8% from last week to 7.5 mio t. Japanese steel company Nippon Steel and mining company Peabody agreed on a 300 USD/t PCI benchmark for Q1 2022 FOB (+20% to Q4 2021 benchmark of 250 USD/t).

Source: CAA