(Mysteel) Freight charges for Capesize carriers shipping iron ore from Brazil and Australia to China have risen to a relatively high level, having doubled over the past month mainly because the major iron ore miners are active in shipping their ore, according to market sources on Friday (July 3).

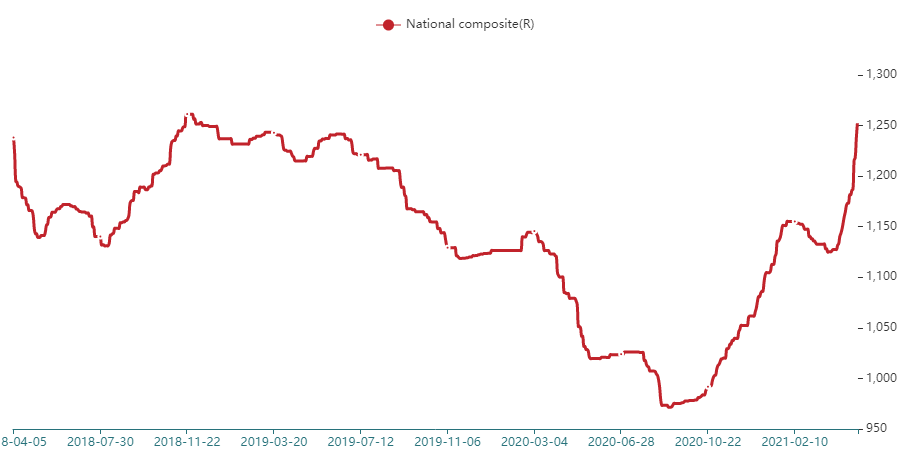

As of July 2, the freight charge between Brazil’s Tubarao and China’s Qingdao ports stood at $19.93/tonne, up by a large $11.43/t or 134.4% on month, though down $1.79/t or 8.2% on week. Similarly, freight between Port of Dampier in Western Australia and Qingdao also rallied to $10.42/t by July 2, higher by $5.94/t or 132.3% on month, also up $0.68/t or 7% on week. Overall, freight charges for both routes were still at the highs recorded since last December.

“This ongoing rise in freight rates for Capesize carriers is largely a result of the major iron ore miners in Australia and Brazil actively shipping their iron ore tonnages when ore prices are persistently hovering at relatively high levels,” a Singapore-based analyst commented.

Mysteel’s survey also showed the same trend, with the total volume of iron ore dispatched to global destinations from the 19 ports and 16 mining companies in Australia and Brazil reaching 109.53 million tonnes in the four weeks over June 1-28, up by 16% from the previous four weeks. Over the survey period, the volume from Australia climbed by 12% and that from Brazil was higher by 29%.

According to the analyst, the recent softening of freight charges in the Atlantic market occurred because the previous surge in charges had resulted in more cargoes being allocated to this area, which saw the limited availability gradually ease.

Nevertheless, for now the higher freight charges don’t seem to be pushing iron ore prices higher, Mysteel Global observed.

During June, Mysteel’s SEADEX 62% Fe Australian Fines, for example, just hovered in the $98.6-105.65/dmt range, and as of July 2 it stood at $99.75/dmt. Similarly, Mysteel’s SEADEX 65% Fe Brazilian Fines lingered in the band of $112.75-119.65/dmt in June and stood at $113.05/dmt on July 2. Both are in terms of CFR Qingdao, East China’s Shandong province.

Capesize dry bulk carriers, usually at 100,000 deadweight tonnes and above, are most engaged in shipping iron ore from Australia, Brazil, and South Africa, to destinations such as China, Mysteel Global notes.

Source: Mysteel Global

Follow Mysteel on Twitter:

[tfws username=”MysteelGlobal” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]