Coal is still a glowing part of global commodities markets even if prices for the energy source are sliding.

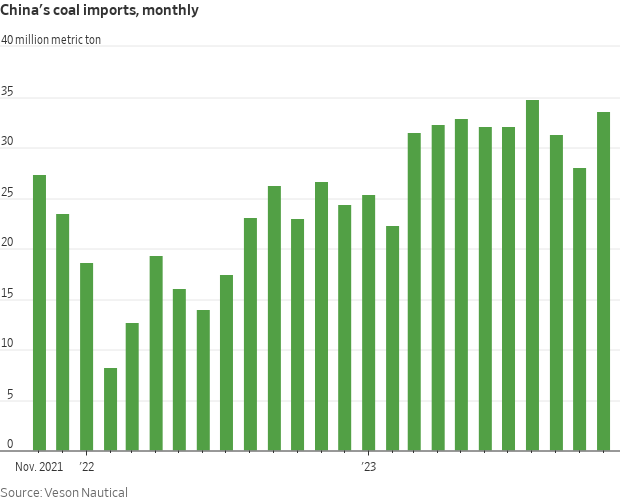

Despite widespread perceptions that the coal industry is under threat, output is actually hitting new records—at least outside the U.S. and EU. The WSJ’s Megha Mandavia reports in a Heard on the Street column that China’s voracious appetite for thermal coal is a big driver of the market, and the country built up coal stocks in 2023 thanks to an influx of supply from Indonesia and Australia and an uptick in coal mining globally.

Yet prices of Newcastle thermal coal, the main Asian benchmark, have fallen about 13% over the past month, according to Refinitiv.

Newcastle coal prices are down 66% over the past year. One main reason: Global coal production rose about 1.8% in 2023 to a record 8.7 billion metric tons, according to the International Energy Agency.

Source: Wall Street Journal