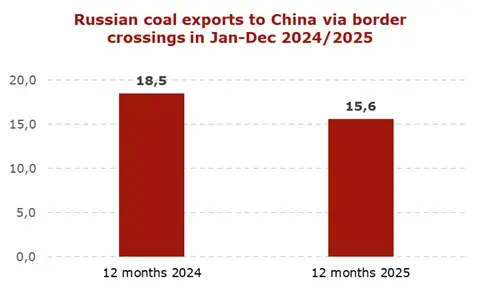

Russian coal exports to China via rail border crossings fell sharply in December 2025, declining 27% year-on-year amid weaker demand and mounting logistical constraints.

In January-December 2025, Russian railway coal exports to China via border crossings fell to 15.6 mio t (-2.9 mio t or -15.7% vs. Jan-Dec 2024).

Shipments in December dropped to 1.05 mio t, marking a 27% contraction year-on-year.

The decline was driven by a combination of weaker demand in Chinese northern provinces and persistent logistical bottlenecks on the Eastern Range.

Furthermore, Russian exporters have shifted a growing share of supplies toward more profitable seaborne deliveries, where CFR price gains in the last months of the year have significantly outpaced overland DAP pricing. While border crossings shipments retained a competitive edge in August due to lower transportation costs, the widening CFR-DAP price spread by the end of 2025 made seaborne deliveries far more economically attractive.

Along with the price pressure and subdued demand, Russian suppliers faced reduced railway capacity on routes to border crossings with China in addition to Russian Railways’ (RZD) refusal to approve applications for cross-border shipments, filed by Russian mining companies, in the full amount.

The situation underscores a deeper, systemic issue: a long-standing shortage of rail transport capacity on the Baikal-Amur Mainline (BAM) and Trans-Siberian Railway has led to exports being heavily dependent on the infrastructure of a rail monopoly, which still lags significantly behind market requirements.

Source: CCA