China’s coking coal and coke prices will probably persist at their respectively high levels for July-December, and the average coking coal price may strengthen from H1 while that of coke may soften from H1, Mysteel shared its market outlook on these two products.

For H2, supply tightness particularly for premium coking coal will sustain despite that China’s coking coal miners will ramp up their production, while China’s coke price will be facing a mix of positive and negative factors such as high coking coal prices while thin steel margins and possible softening in demand, Mysteel pointed out.

China’s coking coal demand to strengthen, supply to recover

For H2, China’s coking operational rate is anticipated to stay high on the boost of healthy coking margins and less disruption of the pollution control on industrial activities in general, and demand for coking coal, together with the commissioning of new coking capacities with more advanced technology, will grow steadily and gradually, particularly for premium quality supplies, Mysteel noted.

Recently, demand for coking coal from the coke producers have been dampened by softening coke prices, but demand will pick up in the October-December quarter as they will need to build up stocks in preparation for the operations during the winter months.

As for supply, China’s coking coal miners have been gradually resuming operations after the suspension since late June due to the workplace safety checks after the few mining accidents and the grand celebration on July 1, and there are still newly-completed coking coal project with advanced technologies to be commissioned in H2, though the actual output from these new projects are still uncertain, Mysteel shared.

In H2, China’s coking coal imports may be hard to match the volume a year ago, as non-Australian coal will be unable to fill up the gap left by the Australian coking coal, and uncertainties still hover over Mongolian coking coal imports because of the country’s COVID-19 situation, Mysteel noted.

China’s coking capacity to expand, demand with uncertainty

For the second half of 2021, China’s coking capacity is anticipated to continue to expand with the commissioning of new coke ovens, thus to make up for the reduction in capacity in 2020 because of the massive closure of the obsolete facilities, and for 2021, the country’s coking capacity is expected to grow by a net 38.3 million tonnes/year with 19.7 million t/y already added in H1, according to a Mysteel’s market survey.

If realized, the added capacity will surpass the net decline by some 25 million t/y last year, as reported.

However, coke supply may still be disrupted now and then in H2, as East China’s Shandong, a core coking base for example, is committed to trimming its coking capacity to 33 million t/y from 46 million t/y and to limiting its coke output within 32 million tonnes for 2021.

For the time being, all the coke ovens in Shandong have been operating as per normal.

A stringent execution of these targets, however, will lead to a reduction in coke supply by 6-8 million tonnes for H2, according to Mysteel’s calculation.

Another great uncertainty in China’s coke demand lies in that whether the country will curb its crude steel production and how serious the cut will be, Mysteel pointed out, as the rapid growth in steel output in H1 will lead to a severe cut for the country to achieve lower steel output on year for 2021, and that will seriously impacted demand for coke, though the signs so far have remained unclear.

China, a key coke supplier in the world, however, will most likely to see its coke exports increase in H2 in response to the recovery in demand from other economies.

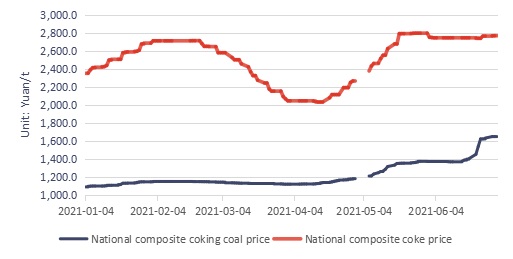

China’s H1 coke price widely fluctuates, coal price swells in Q2

In the first half of 2021, both China’s coking coal and coke prices have been rather resilient in general among exceptional robust demand together with high steel output while at the same time the constrained supplies because of the environmental protection efforts and workplace safety checks at the mines particularly in Shanxi, a core production base for both the commodities.

Coke price had been very volatile, hitting its 12-year high in February due to the concentrated elimination of obsolete coking capacities during the final quarter of 2020 while the remaining solid demand, and the seesawing between coke plants and steel mills in China saw the price fluctuate violently by Yuan 800/t ($123.6/t).

Chart: China’s coking coal and coke prices in H1