Over the past week, European thermal coal indices fell below 119 USD/t, pressured by lower gas and electricity prices, as well as a comfortable level of ARA stockpiles. Furthermore, clean dark-spreads in Germany turned negative (-9 EUR/MWh), whereas a week earlier they were positive at about 9 EUR/MWh. Meanwhile, the share of renewables in Germany’s energy mix dropped from 48% to 35%, while the share of fossil fuels rose from 52% to 65%.

Gas quotations at the TTF hub decreased slightly to 450.17 USD/1,000 m3 (-9.49 USD/1,000 m3 w-o-w). Coal stocks at ARA terminals totaled 3.9 mio t (+0.03 mio t w-o-w), which at current consumption rates will be enough for almost 3 months.

South African High-CV 6,000 ended the week at 110 USD/t on mixed signals. Overall, the prices were under pressure from the negative dynamics on the European market coupled with low demand. On the other side, some support came from supply constraints due to the closure of truck access to Mozambique for exports via the port of Maputo.

Political unrest in Mozambique after the past elections and incidents of truck arson prompted the South African authorities to temporarily close the borders, making it impossible to deliver South African coal by road to the Mozambique export terminal.

Glencore reported a 21% decline in South African thermal coal production to 8.2 mio t in January-September 2024, attributed to transportation capacity constraints. Of this, 3.8 mio t was directed to the domestic market (+0.9 mio t y-o-y). The company will consider ramping up output if the situation with the country’s railroad infrastructure improves. For 2024, Glencore expects thermal coal production to reach 98-106 mio t vs. 107 mio t in 2023.

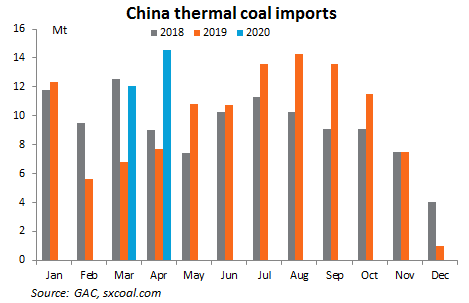

In China, spot prices for 5,500 NAR coal at the port of Qinhuangdao eased to 120 USD/t. Some market participants are cautiously negative because of the warm weather and signs of oversupply amid rising inventories at power plants and seaports.

Moreover, during a recent meeting, mining and generating company Shenhua voiced a forecast that high rates of production and imports will persist, putting even more pressure on the domestic market next year, stemming from increased solar and wind generation capacity. According to some estimates, prices for 5,500 NAR coal could slide to 105.5 USD/t FOB Qinhuangdao, while in 2024 the average price is 122.5 USD/t FOB.

However, the mining regions remain optimistic in the short term on the expectation of TPPs restocking as well as the steady demand from the chemical industry. Also, some market participants forecast a rebound in FOB prices in mid-November, given the increase in heating demand in some regions, including central and eastern China.

Inventories at the 6 largest coastal thermal power plants climbed to 14.84 mio t (+0.12 mio t w-o-w).

In Indonesia coal indices showed mixed dynamics. Indonesian 5,900 GAR amounted to 94 USD/t (+1 USD/t w-o-w), while 4,200 GAR was marginally down to 52.3 USD/t.

Low activity on the spot market was caused by restrained demand, resulting from the gradual return of Indian buyers after the holidays as well as high stocks in China. Pressure on quotations was also exerted by steady supply.

Australian High-CV 6,000 went down below 144 USD/t on the back of the European energy market correction and the completion of the maintenance cycle for shiploaders and berths at export terminals in Australia. With high prices for Australian material and sanctions against Russia, Japan ramped up imports from Colombia (up 143%) and South Africa (up 16%) in September, as well as from other countries including Kazakhstan.

Australian HCC metallurgical coal index adjusted below 205 USD/t, following uncertainty and a wait-and-see attitude among market participants. Suppliers tried to make index-linked deals or postpone negotiations as the past and next week are linked to such important events as the US election and the Fed interest rate decision.

However, a significant drop in prices is unlikely as the spot market is tight on the supply side, given the limited resources available to traders.

Source: CCA Analysis