The use of hard coal for power generation in Germany has fallen dramatically in 2017 (-17%). For 2018, a decline of more than 20% is expected. This is mainly due to the increased feed-in of renewable energy sources, in particular wind energy. Hard coal has thus already almost fulfilled its contribution to the CO2 reduction targets in the context of the Federal Government’s climate protection plan.

Therefore, there is no reason to intervene in the ownership of power plants in the framework of the Commission “Growth, Structural Change and Employment” through a phasing out date for power production from coal. In the context of a commensurability test, it should be verified that such an intervention is also necessary. However, since the feed-in priority for renewables has already displaced natural gas and hard coal from power generation and the tightening of emissions trading will amplify this effect, an intervention in the property rights is not required and an expiry date for the power production from hard coal thus a violation of the property rights regulated in the Basic Law of the Federal Republic of Germany.

Phasing out coal would also not help Germany to achieve the greenhouse gas emission reduction agreed in Brussels on 14 May 2018 for non-ETS sectors such as industry and transport (Effort Sharing). Until 2030 this area has to independently realize a reduction of 38% compared to 2005!

It would also be energy-economically counterproductive to impose a burden of adjustment on hard coal above average. Because hard coal power plants are needed for the energy transition. They protect against blackouts during peak loads and as a back-up when it is dark (no solar power) and there is no wind either, but power demand is high. And in contrast to open cycle gas turbines, which have a lower efficiency, coal-fired power plants are reliably available already today.

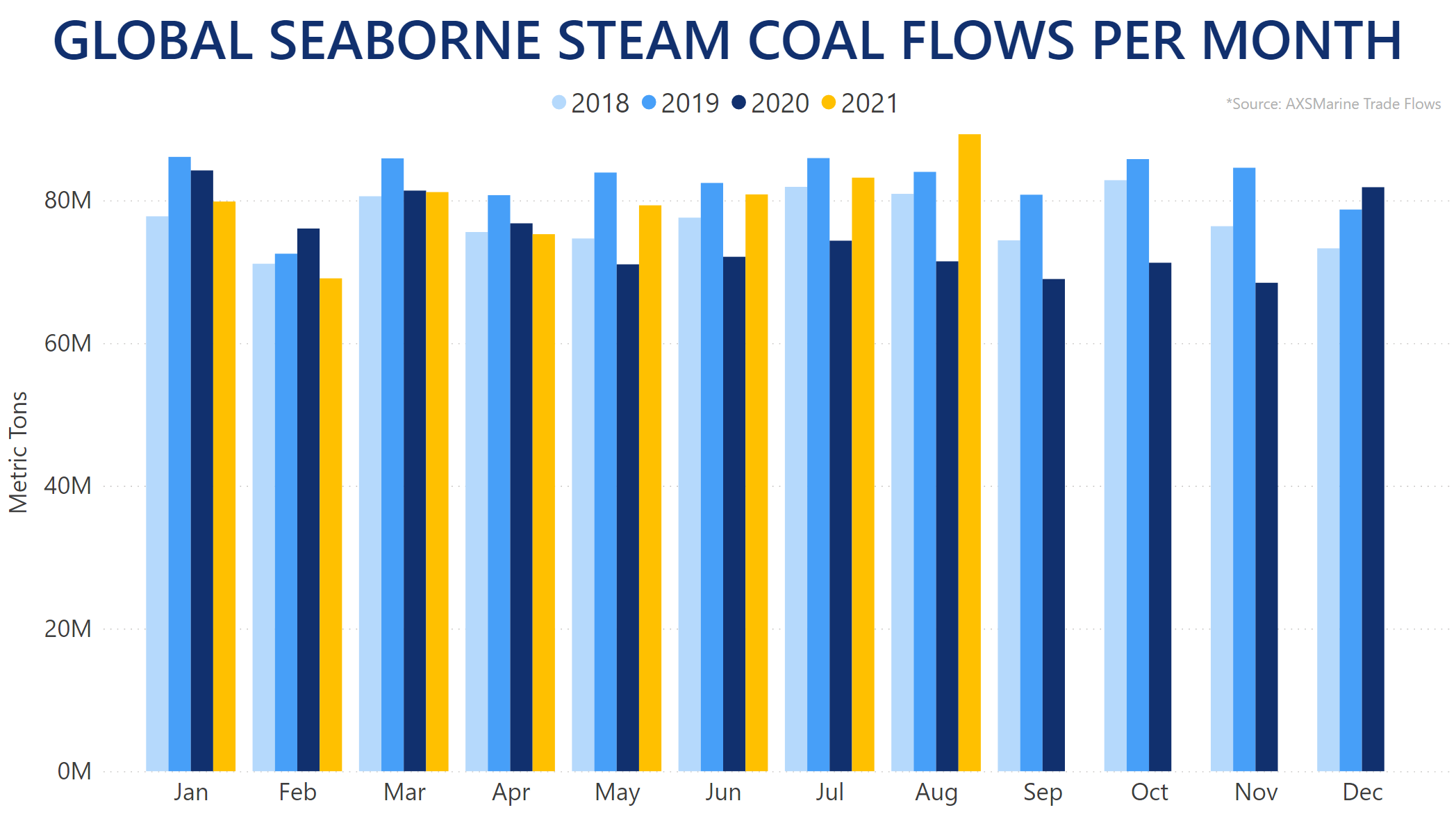

After two years of declining global coal production and declining world trade, the market has recovered significantly. New power plants are being built in many emerging and developing countries. The decline in consumption, primarily in Europe, is thereby more than compensated.

Imported coal is available all over the world and is also needed in Germany for a secure and affordable energy supply. In an open economy, the demand of primary energy sources on the world market is also a contribution to achieving a balance in trade with our partners.

Source: VDK (The Coal Importer Association of Germany)